Tax Clearance Certificate in the Philippines

A Tax Clearance Certificate (TCC) is essential for both individuals and businesses. Whether you’re pursuing business ventures, engaging in government transactions, or applying for a new job, having a TCC can be crucial. However, incomplete documents, outdated information, or unpaid taxes can lead to delays or even rejections.

In this blog, we’ll walk you through the common issues people face when applying for a TCC and offer tips on how to avoid these pitfalls, making the application process as smooth as possible.

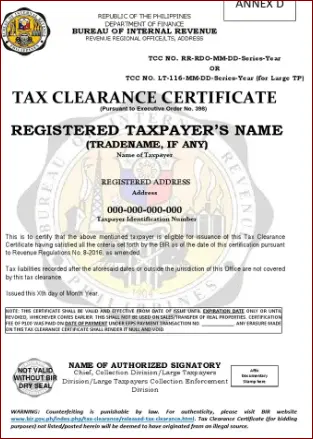

Tax Clearance Certificate Sample

What is a Tax Clearance Certificate?

In the Philippines, Tax Clearance Certificate (TCC) is an official document issued by the Bureau of Internal Revenue (BIR) that confrms a taxpayer’s compliance with tax regulations. This certificate verifies that you have no outstanding tax liabilities.

Purpose of a Tax Clearance Certificate

There are various reasons why a Tax Clearance Certificate (TCC) might be necessary in the Philippines. Here are some of the most common purposes:

- Government Transactions: A TCC is required for entering into contracts with government entities, such as bidding on projects or obtaining permits.

- Loan Applications: Banks and financial institutions often request a TCC when processing loan applications, as it helps assess the applicant’s financial stability and reliability.

- Accreditation and Licensing: Some government agencies and private organizations require a TCC as part of their licensing or accreditation processes.

- Business Renewals: Businesses may need a TCC to renew various licenses or permits, such as franchises issued by the Land Transportation Franchising and Regulatory Board (LTFRB).

- Other Transactions: A TCC may also be needed in situations like selling real property or applying for a promotion in government service (excluding Cabinet members).

Tax Clearance Certificate Required Documents

The specific documents you need to submit depend on whether you’re applying as an individual or as a business representative.

- For Individuals:

- Completed Application Form: Obtain this form from your local BIR office, ensure it’s fully filled out, and include a documentary stamp.

- Proof of Identification: Submit a photocopy of any government-issued ID (e.g., passport, driver’s license) along with three sample signatures.

- Proof of Payment: Include a photocopy of the receipt showing payment for the certification fee and documentary stamp.

- Delinquency Verification Report (DVR): This report can be obtained from the BIR Regional District Office (RDO) you’re registered with.

- For Businesses:

- In addition to the documents required for individuals, businesses may need to submit:

- Business Registration Papers: Such as a Certificate of Registration (COR) or Business Permit, verifying your business’s legitimacy and registration status.

- Audited Financial Statements (for corporations): To provide transparency to the BIR.

- Income Tax Returns (ITRs) for Previous Years: To show your business’s tax filing and payment history.

- Proof of Settlement of Tax Liabilities: Such as official receipts or certificates showing any unpaid tax debts have been settled (includes payments for income tax, withholding taxes, etc.).

- In addition to the documents required for individuals, businesses may need to submit:

Eligibility Criteria for a Tax Clearance Certificate

To qualify for a Tax Clearance Certificate (TCC) in the Philippines, you must be fully tax-compliant, meaning all required taxes have been filed and paid, and there are no outstanding tax liabilities, fines, or surcharges due to late filing or payments.

Online Process for Obtaining Tax Clearance Certificate

To apply for a TCC online, follow these steps:

- Gather Required Documents: Prepare the relevant documents based on whether you’re an individual or a business entity.

- Visit Your BIR RDO: Go to your nearest Bureau of Internal Revenue (BIR) Regional District Office.

- Submit Your Application: Present your completed application form along with all necessary documents to the BIR RDO staff.

- Pay Fees: Pay any applicable fees for processing and documentary stamps.

- Processing and Release: Once processed, the BIR will notify you when your TCC is ready for collection.

Validity of a Tax Clearance Certificate

A TCC remains valid as long as you stay tax-compliant with the BIR. The certificate itself has no expiry date, and instead of renewing, you simply apply for a new TCC to reflect your current tax status if needed.

Processing Time and Fees for a Tax Clearance Certificate

According to the BIR, processing a TCC application with complete documents takes approximately 10 hours and 13 minutes. The main fees are as follows:

Documentary Stamp Tax: Usually a small fee of around Php 30 for the required documentary stamp on the application.

Certification Fee: Typically around Php 100.

FAQs

Conclusion

Obtaining a Tax Clearance Certificate (TCC) in the Philippines is essential for both businesses and individuals. The TCC serves as proof of your compliance with tax laws and is often required for various transactions.

By following the steps in this guide and understanding the necessary requirements, you can make the TCC application process smooth and efficient. Staying informed about tax regulations and meeting deadlines will help you avoid penalties and maintain good standing with the Philippine Bureau of Internal Revenue (BIR).